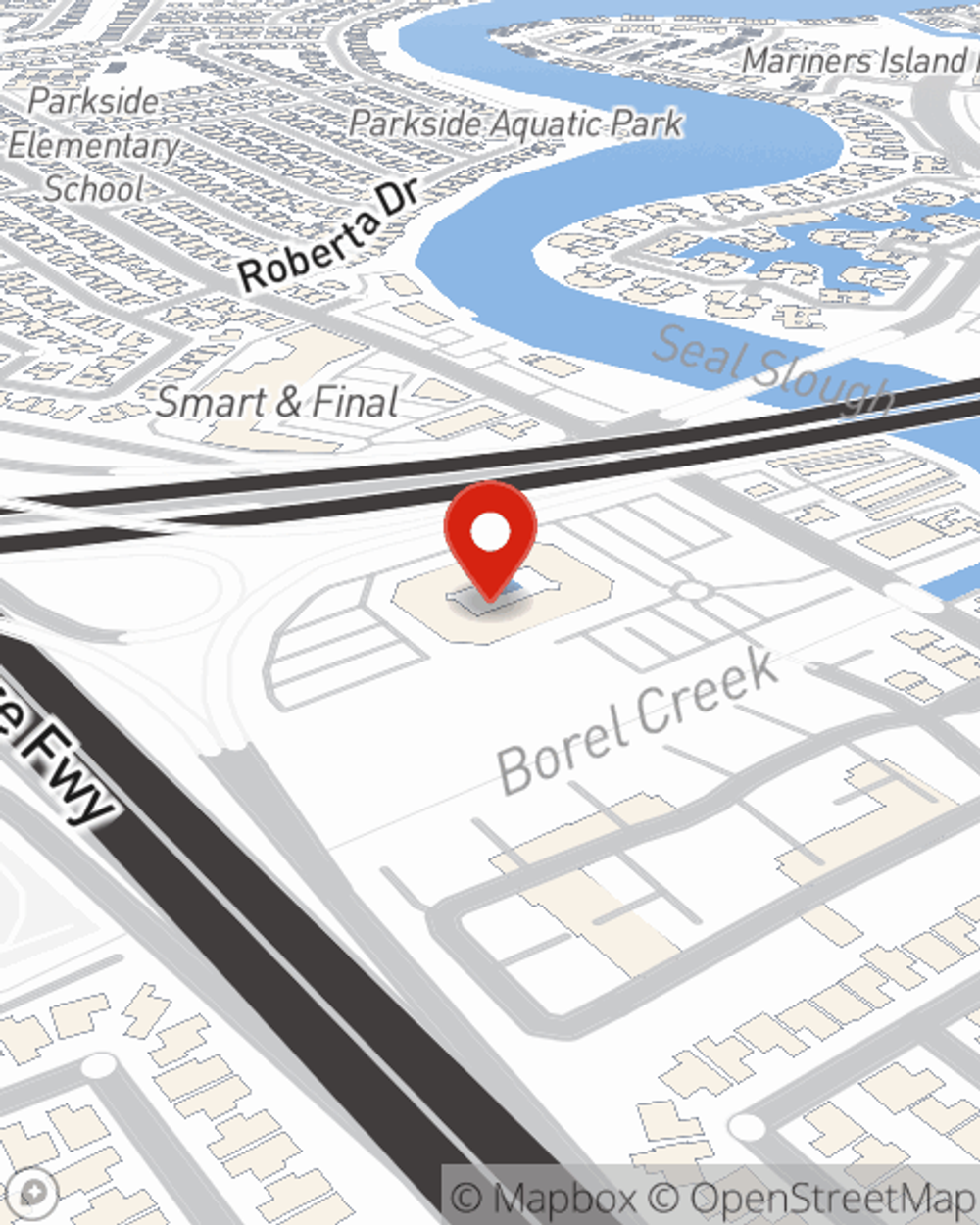

Business Insurance in and around San Mateo

Get your San Mateo business covered, right here!

Cover all the bases for your small business

- Arizona

- Mesa, Arizona

- Oregon

- Bend, Oregon

- the Bay Area

Insure The Business You've Built.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected accident or loss. And you also want to care for any staff and customers who hurt themselves on your property.

Get your San Mateo business covered, right here!

Cover all the bases for your small business

Small Business Insurance You Can Count On

Planning is essential for every business. Since even your brightest plans can't predict consumer demand or natural disasters. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for protection with a State Farm small business policy. Business insurance is necessary for many reasons. It protects your hard work with coverage like errors and omissions liability and business continuity plans. Terrific coverage like this is why San Mateo business owners choose State Farm insurance. State Farm agent Jim Breen can help design a policy for the level of coverage you have in mind. If troubles find you, Jim Breen can be there to help you file your claim and help your business life go right again.

So, take the responsible next step for your business and reach out to State Farm agent Jim Breen to explore your small business insurance options!

Simple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Jim Breen

State Farm® Insurance AgentSimple Insights®

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.